From development land, residential land to townhomes whatever you are looking for RPM has the ideal location for you.

From development land, residential land to townhomes whatever you are looking for RPM has the ideal location for you.

Development Land

Specialists in sourcing and selling development land for commercial and residential projects. Explore current and past opportunities.

Residential Land

Across Australia’s East coast RPM has the ideal land to suit your lifestyle and dream home, explore the projects RPM is proud to be partners in selling.

Townhomes

With townhouses to suit every lifestyle and budget, find your perfect home today.

Apartments

Inner city & coastal new apartment projects. Explore our projects to find your perfect location and style of living.

RPM offer a comprehensive suite of professional services at every stage of your property journey.

RPM offer a comprehensive suite of professional services at every stage of your property journey.

Pioneering new benchmarks in property intelligence, know-how, and data-driven insights, read the RPM Group's story.

Our Story

Since 1994, RPM has grown to become the industry-leader with an expanding national presence; offering a comprehensive suite of services

Our Team

The heart of our business are the people who make it thrive. Discover the passion and dedication of our national team.

Careers

Our team of property experts is truly unparalleled. See how you can join this exceptional group and shape your future with us.

11.06.2024

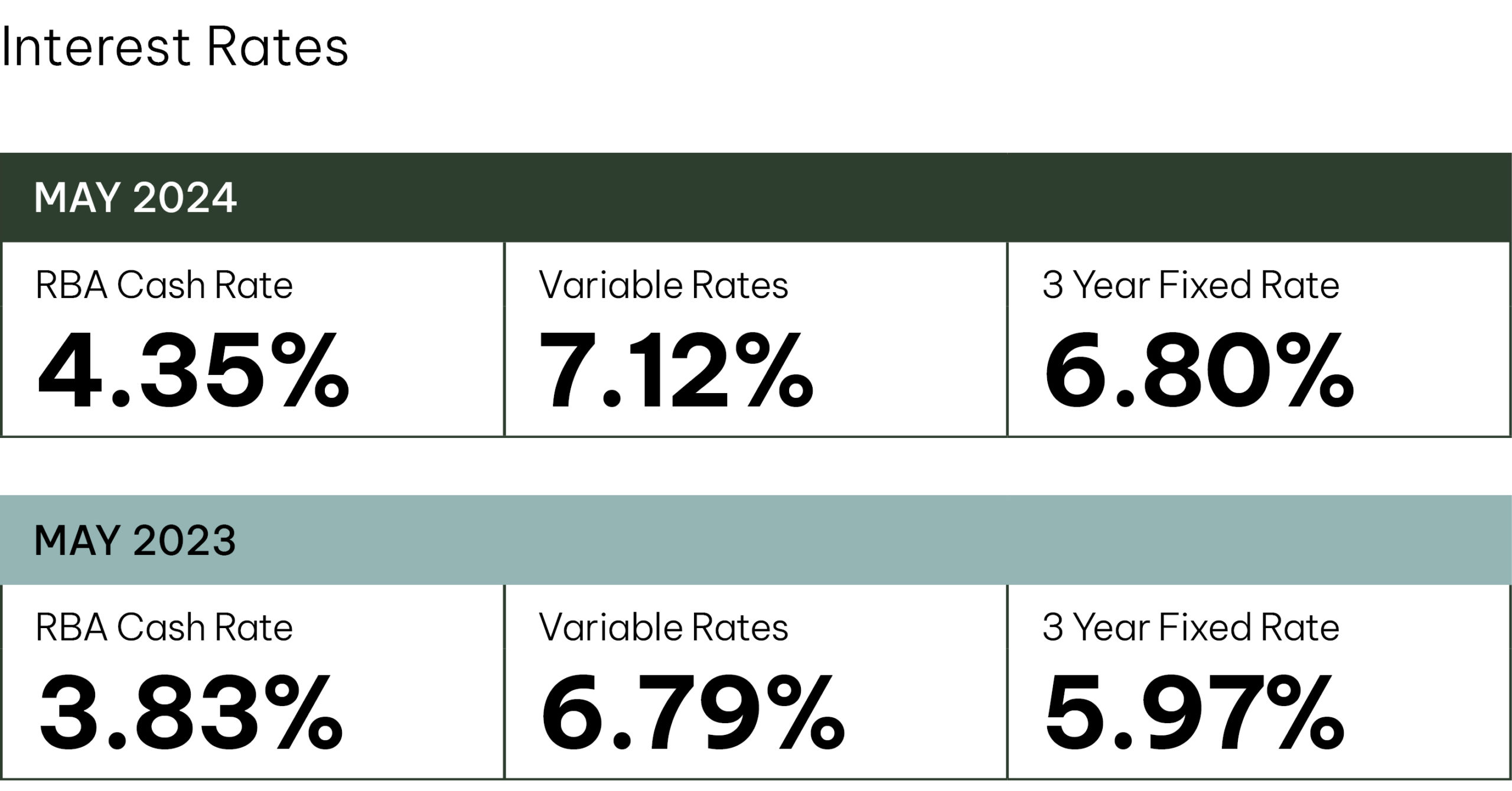

Interest rate volatility returned in April 2024 after a period of stability due to Q1’s 0.96% quarterly CPI (Consumer Price Index) growth that exceeded expectations. This dampened the near-term inflation outlook, with the RBA (Reserve Bank of Australia) forecasting CPI growth will remain sticky at an annual rate of 3.8% over the year.

Persistent growth in cost-of-living expenses will continue to erode household finances, making it harder to save for property deposits. This is compounded by the approximate one-third reduction in borrowing capacity over the past two years. Additionally, higher inflation could offset some of the benefits of the upcoming stage 3 tax cuts set to come into effect in July 2024, diminishing the projected benefit to low- and middle-income households’ borrowing capacity by around 5%.

While there is a risk of further cash rate rises, it is important to note that the RBA has kept the cash rate on hold at 4.35% at its May meeting and maintained its neutral stance towards the cash rate through 2024, not ruling out a movement either way. This is a change from the tightening bias position it held for much of the previous two years, indicating the current cash rate of 4.35% will remain for a longer period – pushing back potential interest rate cuts.

Nevertheless, the possibility of rate rises may unsettle purchaser confidence in the short term; potentially halting the recovery in sales activity observed in Melbourne’s growth areas this quarter.

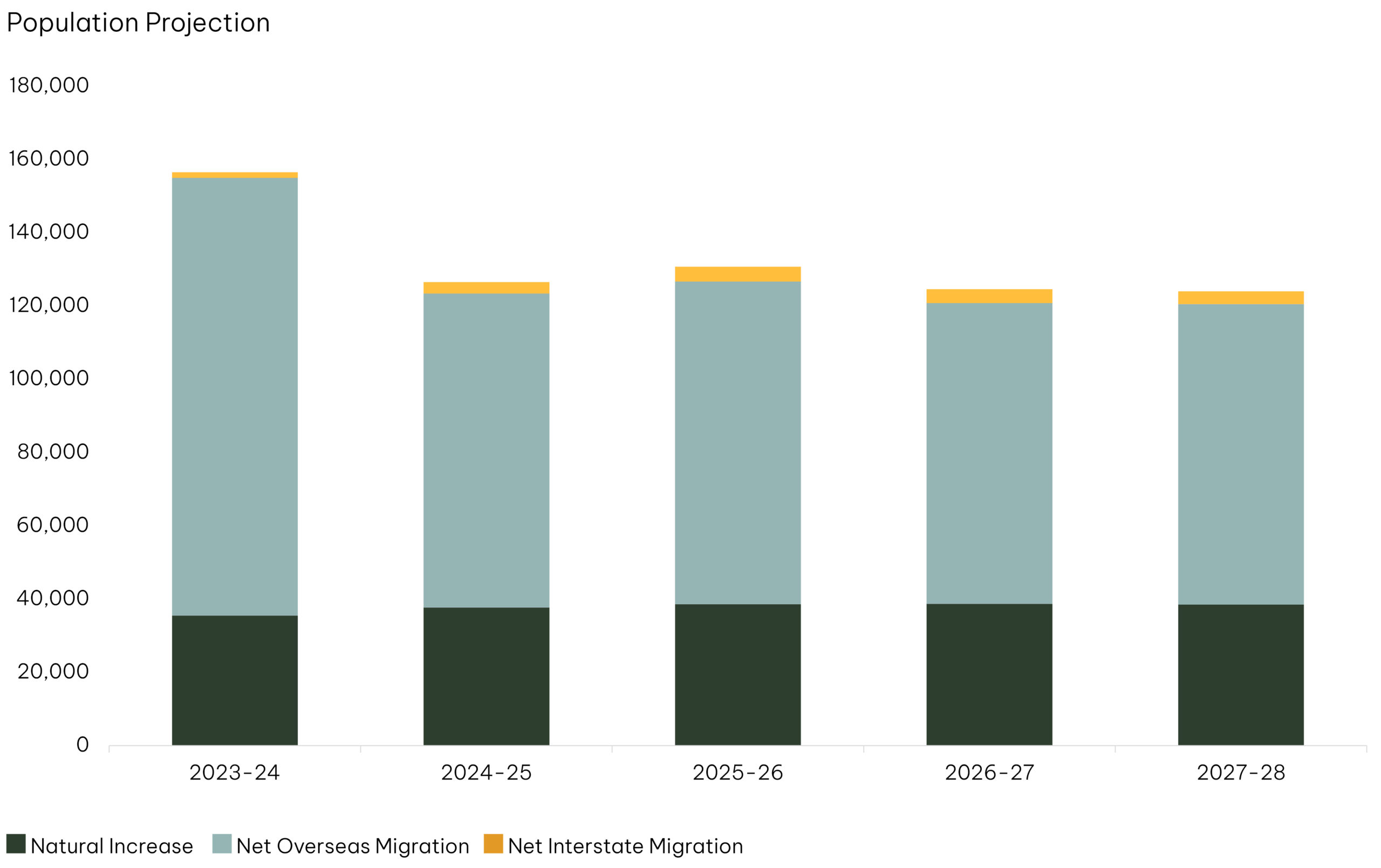

Looking ahead, demand fundamentals for the new home market remain strong. Record net overseas migration in FY22/23 and FY23/24, along with robust population growth, low unemployment figures, and wage growth have contributed to a growing pool of pent-up purchaser eager to buy a property. This is expected to happen from late 2024 or early 2025, as all major banks forecast an easing monetary policy cycle starting in November.

The value proposition of new homes in Melbourne’s greenfield areas remains challenging, although trends from Q1 are promising. The land-to-house price ratio in Melbourne improved to 41%, still above the equilibrium ratio of 35%. Stronger property price growth in other metropolitan centres such as South East Queensland and Perth have narrowed their affordability advantage over Melbourne, which could reduce net outflows to these areas in the future.

The new home market will remain vital to the State Government’s plan to construct 80,000 new dwellings annually over the next decade, with more readily available supply to immediately satisfy current demand. This will be supported by the 2024/25 Budget’s additional $700 million allocation to the Victorian Homebuyer Fund, with property caps of $950,000 in Metropolitan Melbourne and $700,000 in regional Victoria. These measures accommodate most new house and land packages currently being marketed.

This article references findings from our Q1 2024 Victoria Greenfield Market Report.

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/