From development land, residential land to townhomes whatever you are looking for RPM has the ideal location for you.

From development land, residential land to townhomes whatever you are looking for RPM has the ideal location for you.

Development Land

Specialists in sourcing and selling development land for commercial and residential projects. Explore current and past opportunities.

Residential Land

Across Australia’s East coast RPM has the ideal land to suit your lifestyle and dream home, explore the projects RPM is proud to be partners in selling.

Townhomes

With townhouses to suit every lifestyle and budget, find your perfect home today.

Apartments

Inner city & coastal new apartment projects. Explore our projects to find your perfect location and style of living.

RPM offer a comprehensive suite of professional services at every stage of your property journey.

RPM offer a comprehensive suite of professional services at every stage of your property journey.

Pioneering new benchmarks in property intelligence, know-how, and data-driven insights, read the RPM Group's story.

Our Story

Since 1994, RPM has grown to become the industry-leader with an expanding national presence; offering a comprehensive suite of services

Our Team

The heart of our business are the people who make it thrive. Discover the passion and dedication of our national team.

Careers

Our team of property experts is truly unparalleled. See how you can join this exceptional group and shape your future with us.

29.08.2023

The cash rate has increased by a cumulative 400 basis points since May 2022, resulting in decreased demand and fewer prospective buyers. Although the cash rate is believed to have nearly reached its peak, the Reserve Bank of Australia’s (RBA) tightening bias signals the possibility of one more rate rise in the coming months – indicating we’ve nearly reached the light at the end of the tunnel.

Our latest Greenfield Market Report shows that although the established housing market is facing limited supply, it is certainly showing positive signs with improved clearance rates – an indication that positive trends are starting to emerge.

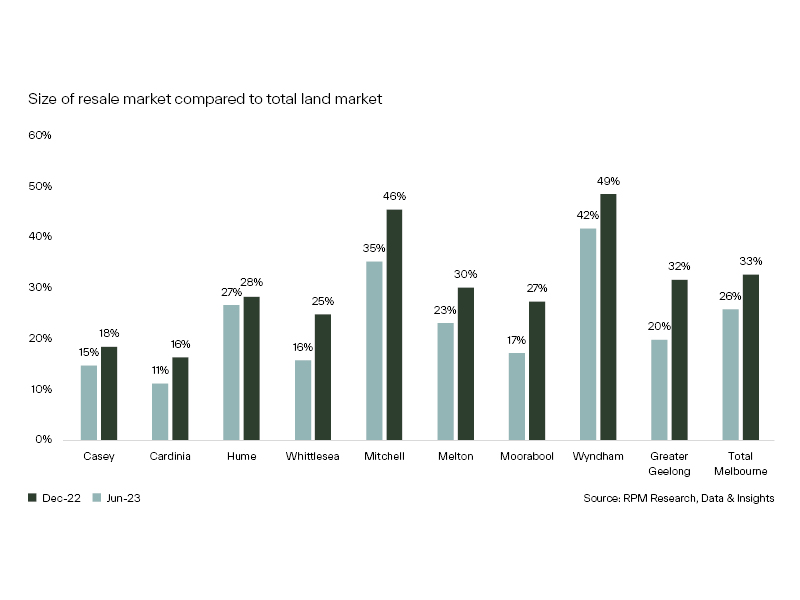

Our June 2023 findings reveal a 71% increase in resale lots across all growth LGAs within six months, highlighting the shifting buyer landscape and the current challenges they face.

The mounting supply of resale lots is indicative of increased household finance pressures. The increased interest rates and heightened building costs have led recent buyers to re-evaluate their financial capacity to build new homes – choosing to resell. This trend affects owner occupiers unable to settle, including first homebuyers grappling with increased interest payments, and investors navigating a more challenging lending environment.

In terms of specific areas, Casey experienced the most significant increase (+15.6%) in the proportion of titled lots on the resale market, while Cardinia witnessed the largest fall(-17.8%). Across most LGAs, the average price of resale lots has declined, with notable price changes observed in Mitchell by +2.7% (+$9,391) and Surf Coast by -8.1% (-$78,256). Interestingly, the average size of resale lots in most areas has grown over the first half of 2023, resulting in an overall average lot size increase of 3.3% (+14sqm to 442sqm) for Melbourne and Geelong. As a result, the average price per square metre rate across the region has decreased by 3.5% or by $34 to $9,842.

Additionally, when comparing primary and secondary land markets, all lots within the secondary land market are, on average, 14% larger (at 442sqm compared to 388sqm), yet only 4.6% higher in price (at $416,716) than those in the primary land market. This, coupled with limited sales activity, has led developers to adopt more competitive pricing strategies to facilitate stock movement.

Looking ahead, with the cash rate expected to reach its peak by year-end and no immediate signs of reduction, the total supply of resale lots is projected to continue its upward trend for at least the remainder of the year and into the early months of the following year. Despite this, it is key to note that the market is in fact in the early stages of an upward trend as indicated by two interest rate pauses in the last two months and inflation reducing.

This article references findings from our Q2 2023 Greenfield Market Report.

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/