From development land, residential land to townhomes whatever you are looking for RPM has the ideal location for you.

From development land, residential land to townhomes whatever you are looking for RPM has the ideal location for you.

Development Land

Specialists in sourcing and selling development land for commercial and residential projects. Explore current and past opportunities.

Residential Land

Across Australia’s East coast RPM has the ideal land to suit your lifestyle and dream home, explore the projects RPM is proud to be partners in selling.

Townhomes

With townhouses to suit every lifestyle and budget, find your perfect home today.

Apartments

Inner city & coastal new apartment projects. Explore our projects to find your perfect location and style of living.

RPM offer a comprehensive suite of professional services at every stage of your property journey.

RPM offer a comprehensive suite of professional services at every stage of your property journey.

Pioneering new benchmarks in property intelligence, know-how, and data-driven insights, read the RPM Group's story.

Our Story

Since 1994, RPM has grown to become the industry-leader with an expanding national presence; offering a comprehensive suite of services

Our Team

The heart of our business are the people who make it thrive. Discover the passion and dedication of our national team.

Careers

Our team of property experts is truly unparalleled. See how you can join this exceptional group and shape your future with us.

11.10.2024

The gradual recovery in new home demand that began in Q1 2024 continued into April, with gross lot sales hitting their highest monthly total in nearly two years. This was due to buyers rushing to purchase before the National Construction Code (NCC) changes, which increased new home prices.

However, sentiment shifted in late April, when Q1 CPI data revealed an uptick in inflation. The news dampened market confidence and led to a significant drop in sales activity in May, making it the weakest month for lot sales in 2024, aside from January’s seasonal low.

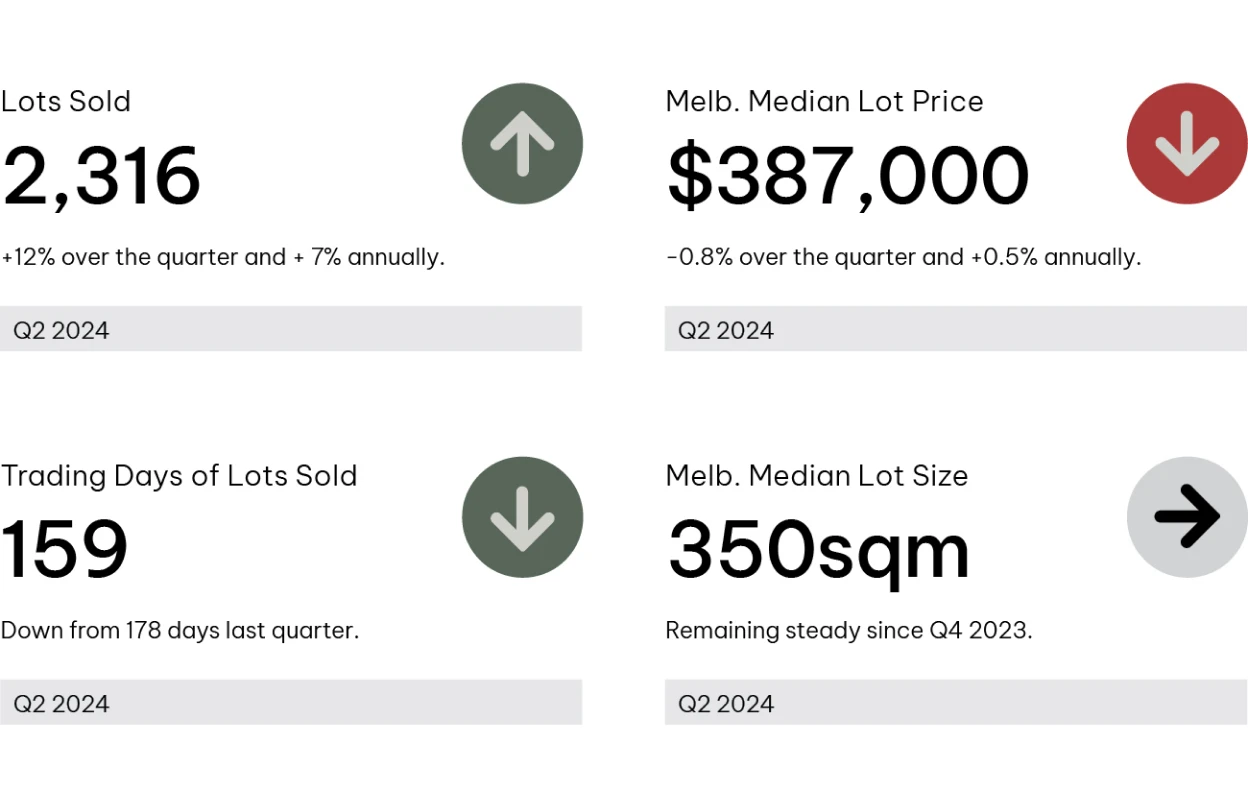

Sales recovered in June as buyers took advantage of end of financial year rebates and discounts, typically ranging from 5% to 10% of the gross lot price. Melbourne’s median lot price increased 1% over the quarter; these incentives are supporting the headline figure remaining at near record levels, edging higher to an average of $387,000 in Q2.

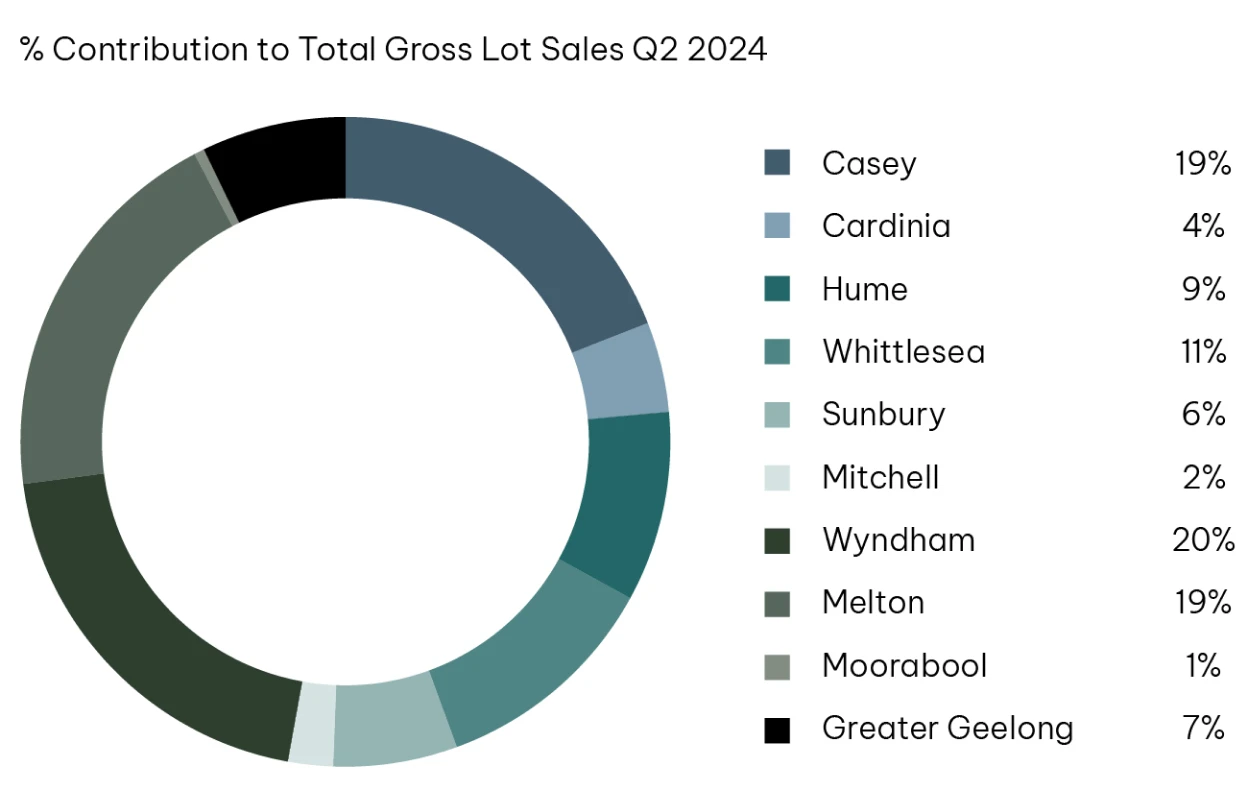

Overall, Melbourne and Geelong’s growth areas recorded 2,316 gross lot sales in Q2 – marking a 12% increase from last quarter and a 7% rise from the same quarter in 2023. Geelong saw a notable 69% increase in sales from its long-term low in Q1, thanks in part to a 5.7% drop in its median lot price.

Looking at the annual trends, three of the four growth corridors saw double digit sales growth, while the Northern saw a decline. In Melbourne, the average trading days for lots improved to around five months this quarter, compared to six months in Q1. Geelong’s trading days extended to over seven months due to a higher proportion of titled lots, which made up 37% of Melbourne’s total sales and 75% in Geelong.

New lot supply increased by 19% over Q2 to 1,812 releases, surpassing corresponding growth for lot sales of 12%. As a result, unsold lots rose by 4% to about 5,266 lots by the end of Q2.

This article references findings from our Q2 2024 Victoria Greenfield Market Report. Read the full report here.

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/